Does The Snowball Method Work? A Financial Strategy Analysis

Debt Snowball Explained For Beginners | How To Pay Off Debt | Debt Payoff | Budget For Beginners

Keywords searched by users: Does the snowball method work snowball method calculator, snowball method vs avalanche method, debt snowball method, debt snowball method example, Snowball method, Debt Snowball là gì, snowball method spreadsheet, debt snowball app

Is The Snowball Method Effective?

Is the snowball method an effective strategy for paying off your debts? When comparing the snowball method to the avalanche method, it becomes evident that the snowball approach offers a quicker path to paying off your first balance. With the snowball method, you can expect to eliminate your initial debt within six months, whereas the avalanche method may take over a year to clear the debt with the highest APR. If you prioritize achieving a swift victory in your debt repayment journey, the snowball method emerges as the more favorable choice.

What Is The Downfall Of The Snowball Method?

What are the drawbacks associated with the snowball method for paying off debt? One significant downside is its impact on interest costs. The debt snowball method may not be the most cost-effective approach for reducing interest expenses. This is because it focuses on tackling smaller balances first, regardless of their interest rates, and often involves making only minimum payments on higher-interest debts further down the list. As a result, individuals utilizing this method may find themselves paying significantly more in interest over the long term compared to alternative debt repayment strategies that prioritize high-interest debts first.

What Are The Pros And Cons Of The Snowball Method?

Exploring the Advantages and Disadvantages of the Snowball Debt Repayment Method

The snowball method, a popular approach to tackling debt, has its own set of advantages and drawbacks. One of its primary benefits is its ability to motivate individuals to stay committed to their debt repayment plan. This technique simplifies the process by focusing solely on the outstanding balances owed, eliminating the need for complex calculations involving interest rates or APRs. However, it’s essential to note that the snowball method may not be the most cost-effective option in terms of reducing overall interest payments when compared to the debt avalanche method. While it offers psychological benefits, such as the satisfaction of paying off smaller debts quickly, it might not be the most financially efficient choice for those seeking to minimize interest costs over the long term.

Summary 23 Does the snowball method work

Categories: Update 94 Does The Snowball Method Work

See more here: c1.chewathai27.com

The truth about the debt snowball method is it’s a motivational program that can work at eliminating debt, but it’s going to cost you more money and time – sometimes a lot more money and a lot more time – than other debt relief options.If you went with the snowball method, you could pay off your first balance in six months, compared to the avalanche method, where it would take you more than a year to pay off your debt with the highest APR. If you’re motivated by a quick win, then the snowball method is a better choice.Interest. The debt snowball method is not necessarily the best choice for saving money on interest. Because you’re prioritizing balances over interest rates and only making minimum payments on debts that are low on the list, you could end up paying considerably more in interest over time.

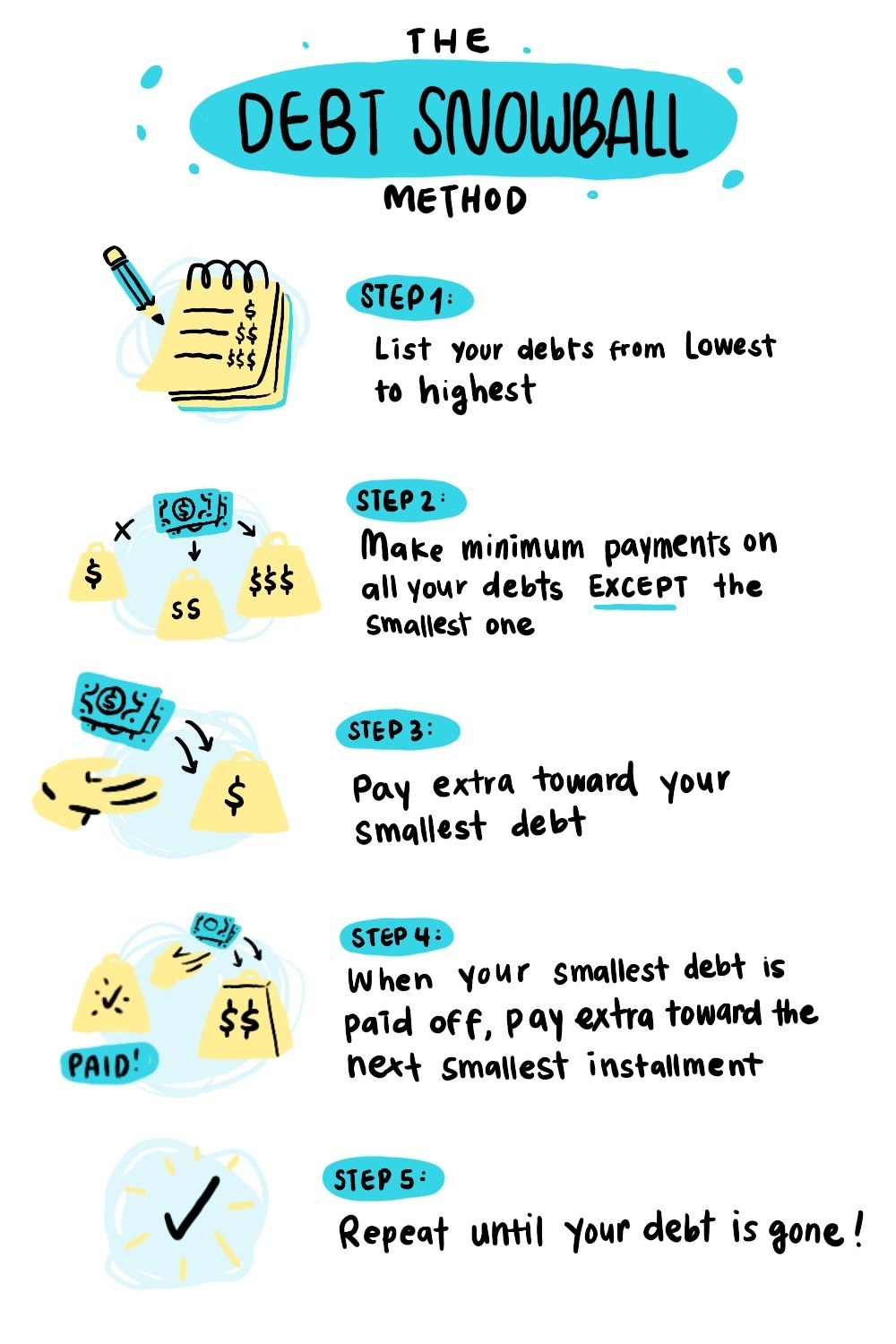

- The debt snowball. The debt snowball method builds momentum as you start repaying creditors, like rolling a snowball across the ground. …

- The debt avalanche. The debt avalanche strategy takes a similar approach but instead orders debts by interest rate. …

- Debt consolidation. …

- Debt management plan.

Learn more about the topic Does the snowball method work.

- What Is the Snowball Method and How Does It Work? – Debt.org

- Debt Snowball vs. Debt Avalanche: What’s the Difference?

- Debt Snowball: Overview, Pros and Cons, Application

- Debt Avalanche vs. Debt Snowball: What’s the Difference? – Investopedia

- How To Pay Off Debt: 3 Strategies And 6 Tips – Bankrate

- How to save for an emergency if you already have credit card debt – CNBC

See more: https://c1.chewathai27.com/category/money-policy